Understanding Treasury Bonds

Treasury securities stand at the core of fixed-income markets. Issued by the U.S. government, they offer investors varying maturities, from short-term bills to long-dated notes and bonds. Widely regarded as nearly risk-free, Treasuries are prized for their deep liquidity and transparent pricing—traits that make them both a benchmark and an ideal vehicle for tactical plays.

What Makes Treasuries Unique

- Sovereign Backing: Payments are guaranteed by the U.S. government’s full faith and credit.

- Deep Secondary Market: Millions of dollars change hands daily, keeping bid–ask spreads razor-thin.

- Yield Curve Signal: Movements in Treasury yields often presage shifts in economic growth and central-bank policy.

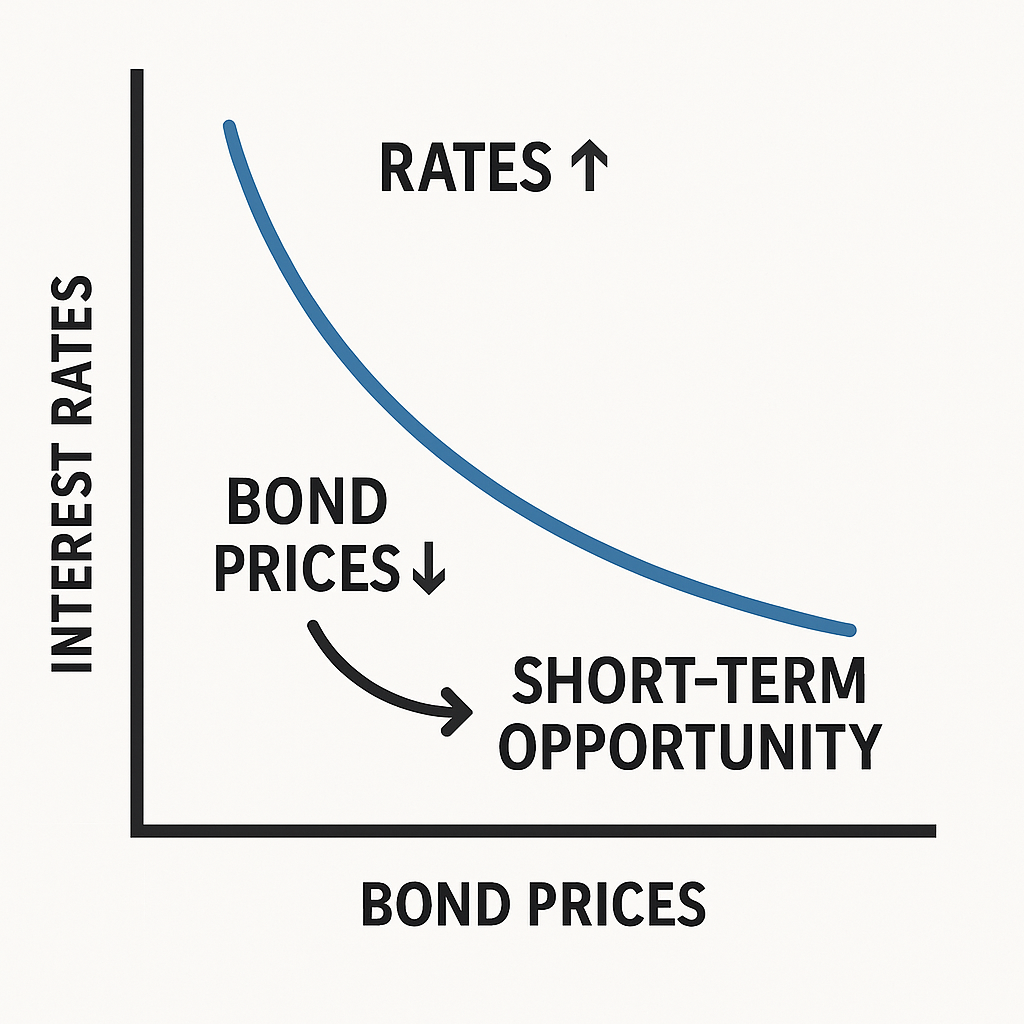

Price–Yield Relationship Basics

The fundamental inverse link between price and yield underpins any bearish approach to government debt. When rates climb, existing bond prices fall; conversely, rate cuts lift bond values. Short sellers capitalize on anticipated yield upticks by borrowing and unloading securities before prices dip, later buying them back at lower levels.

The Mechanics of Shorting Treasury Bonds

Before placing a bearish bet on government debt, traders must grasp the operational steps and margin requirements that accompany such positions.

How Bond Short Sales Work

- Borrowing the Security: Through a broker, you borrow the bond or its cash-settled equivalent.

- Immediate Sale: The borrowed instrument is sold into the market at the prevailing price.

- Repurchase to Cover: If yields rise and prices drop, you buy back at a discount, return the borrowed paper, and pocket the difference—minus financing costs.

Instruments for Shorting Treasuries

| Instrument | Description | Pros | Cons |

| Futures Contracts | Standardized agreements to sell Treasuries at a future date | High leverage, deep liquidity | Mark-to-market margin calls |

| Inverse ETFs & Funds | Funds designed to move opposite to bond-price indices | No margin account needed, easy access | Daily rebalancing decay |

| Options and CFDs | Derivatives allowing bearish bets with limited upfront capital | Defined risk (with puts), flexible size | Premium costs, complex Greeks |

Proven Shorting Strategies

Selecting the right vehicle and timing can dramatically affect performance when betting against government debt.

Using Treasury Futures

Traders often favor futures for their tight spreads and substantial leverage. A short in the 10-year note contract, for example, can multiply small yield changes into meaningful P&L swings—but requires vigilant margin monitoring.

Leveraging Inverse Bond ETFs

Inverse exchange-traded products (like TBF or PBP) provide straightforward bearish exposure without a formal margin arrangement. Be mindful, however, of tracking error and the drag from daily rebalancing, which can erode returns over longer holding periods.

Options-Based Approaches

Derivatives offer customizable risk profiles and cost controls.

Buying Put Options on Bond ETFs

Acquiring puts grants the right—but not the obligation—to sell an ETF at a pre-set strike. Premiums limit downside risk to the option cost, making this a popular choice for tactical, time-limited plays.

Bear Spread Strategies

By selling a lower-strike put and buying a higher-strike one, you offset part of the premium outlay, narrowing profit potential but also reducing net cost—a balanced way to express moderate bearish conviction.

Risk Management & Hedging Techniques

Even well-timed short positions can backfire if unchecked. Robust controls are essential.

Position Sizing and Stop-Losses

- Scale In/Out: Break large bets into smaller tranches to avoid single-point failure.

- Defined Exits: Use protective orders tied to yield thresholds or price levels to cap losses.

Hedging with Interest-Rate Swaps

Entering a pay-fixed, receive-floating swap can offset losses if rates unexpectedly decline, effectively limiting downside in your short bond stance.

Diversification to Mitigate Tail Risk

Combine Treasury shorts with long positions in cash alternatives, other fixed-income sectors, or equities to reduce the blow of abrupt yield reversals.

Tip: Monitoring Key Economic Indicators

Stay attuned to:

- Federal Reserve minutes and speeches

- CPI/PPI inflation readings

- Employment and GDP data

Timely intel helps you adjust exposure before market-moving surprises.

Market Environments Favoring Short Positions

Not every cycle rewards a bearish view on sovereign debt. Recognizing the right backdrop is crucial.

Rising-Rate Scenarios

Periods of sustained Fed tightening and strong economic expansion typically push yields higher, making shorts more profitable.

Central-Bank Policy Signals

Forward-guidance hinting at accelerated hikes can trigger swift bond sell-offs—prime moments for short-term bets.

Inflation and Fiscal-Stimulus Triggers

Surges in consumer prices or heavy government spending often erode bond valuations, paving the way for successful shorting.

Common Pitfalls When Shorting Treasury Bonds

Even seasoned practitioners can stumble—knowing the usual traps enhances your survival odds.

Margin-Call & Liquidity Risks

Price spikes against your position can prompt urgent cash injections. Ensure ample collateral and a cushion to withstand sudden rallies.

Basis-Risk and Roll-Yield Challenges

When using futures or ETFs, the relationship between the contract and underlying cash bond may diverge, especially around roll dates—introducing unexpected costs.

Contango vs. Backwardation Effects

Inverse funds suffer in a contangoed bond market, where longer-dated contracts trade at premium, gradually draining returns through daily rebalances.

Conclusion & Key Takeaways

Shorting government debt can be a potent hedge or speculative tool—but it demands discipline, nuanced execution, and a keen eye on margins and macro catalysts.

Summary of Top Strategies

- Futures Contracts: Best for high-velocity trading and precise targeting.

- Inverse ETFs: Easy access but watch for performance drag.

- Options Spreads: Controlled risk with adjustable payoff profiles.

Balancing Risk vs. Reward in Bond Shorts

Maintain modest position sizes, employ protective stops or hedges, and diversify across asset classes. By pairing strategic timing with rigorous risk control, traders can navigate the complexities of betting against Treasury bonds while preserving capital through unforeseen market reversals.